Back then, at least, we knew who wore the white hats and who whore the black hats. Today, thanks to muddled and often conflicting regulations for multiple agencies, everyone is wearing fifty shades of gray.

Education

The key intent of this strategy is to allow freedom to and reward long-term employees who have accumulated the skills the company needs to compete.

Still, it seems most financial professionals feel anything that brings people closer to the road towards financial independence should be encouraged.

The root of these broader fiduciary concerns lies within the domain of compliance. Everything derives from what the regulators require, what any DOL audit might look at, and what might pique the interest of class-action attorneys.

Oddly the first question, the one asked from the plan sponsor’s perspective, came back with a slightly different answer (identifying appropriate investment options and then providing employee education regarding those options). This second question, from the professional fiduciary’s outlook, adds a bit of emphasis on fees. Are the different responses significant? Is the similarity in responses a problem?

That’s what a new education can focus on. Instead of the same-old-same-old of emphasizing “saving early and often,” education should think past the sale.

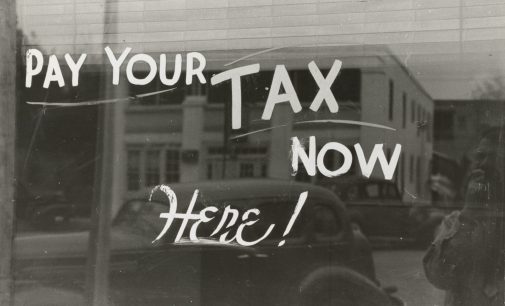

Here’s the irony of the tax saving incentive. If it’s wildly successful and leads to very large retirement accounts, the required minimum distributions at retirement may place the now retired employee in a higher tax bracket than the one experienced while working.

Retirement plan sponsors may also benefit from teaching entrepreneurial skills to their employees. Such lessons could also provide employees with opportunities to begin to practice what they learned directly for their current employer.