Whatever the future holds, we live in a present where there is no such thing as a free lunch; thus, the basic notion of caveat emptor continues to hold true.

The entire Morehouse class of 2019 has just won a lottery of sorts. Like all lottery winners, what happens next will reveal the content of its character. And possibly reveal the ultimate fiduciary lesson.

SECURE Act recap, BI coming, and ESG sizzling.

The One Topic Every 401k Plan Sponsor Must Know Right Now: Fiduciary Education Curriculum (Part III)

Most 401k plan sponsors will readily admit they are not experts when it comes to retirement plans. They understand they have a role in the process. They understand that role carries with it certain fiduciary obligations. They understand (and accept) that role also exposes them to liabilities. This article shows how prudent delegation can mitigate much of that fiduciary liability.

Lotsa compliance talk, little fiduciary talks, and a better understanding of fees.

The Meat and Potatoes Topics of 401k Plan Sponsor Training: Fiduciary Education Curriculum (Part II)

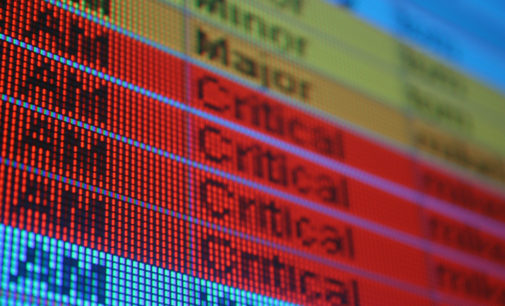

If we liken the “5 Critical Topics” to the skeleton and sinew of a plan sponsor’s fiduciary obligation, the “meat and potatoes” topics can be described as its soft underbelly. It is within the routines of these topics that plan sponsors live most dangerously. What are these next two topics and why is it important plan sponsors to dig deep into them rather than simply “read the headlines”?

Compliance FedSpeak, Fee Recursion, and Parsing Investment Headlines.

These are fundamental in nature. They are necessary prerequisites for 401k plan sponsors to fully inculcate themselves with more complex topics.

Fiduciary Back-Off, Fee Free Lunch, and Bad Bonds

FiduciaryNews.com Trending Topics for ERISA Plan Sponsors: Week Ending 5/31/19

Waiting for the Senate and a Fiduciary guessing game.