Among the consequences that can follow from the Supreme Court’s overruling Chevron is yet more situations for which an answer to a question of law won’t be one bright-line rule made by a government agency.

Interviews

“Industry participants also argue that the rule transforms one-off transactions into fiduciary relationships in violation of the common law, but the common law of the states is divided on this, and there is a need for a federal standard regulating investment advice fiduciaries.”

“This lack of active involvement could lead to inefficiencies, reduced liquidity, and potential market instability, as prices may not accurately reflect the underlying value of securities.”

I don’t think the plan service providers should provide participant advice. Advice to participants should be provided by a non-related third-party fiduciary.

Should 401k plans allow participants to take loans from their retirement savings accounts? Is pre-retirement access to 401k assets constructive or destructive?

“The ERISA plaintiffs’ bar has overlooked the potential value of the Restatement’s prudent investor rule and its application to litigation involving 401k plans.”

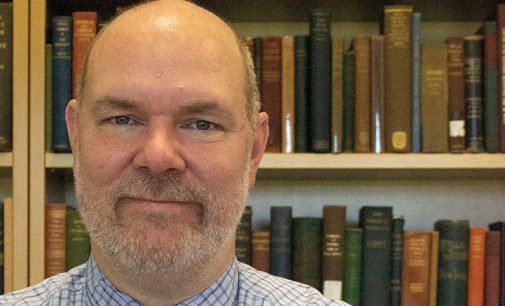

A major retirement industry thought leader collects his gold watch. Here’s his inside story. And he’s sticking to it.

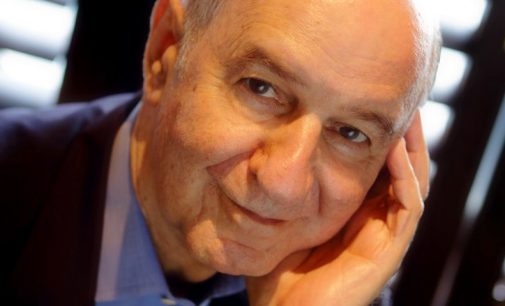

“I was [once] a major skeptic of the use of annuities, I have subsequently changed my mind regarding the efficacy of low-cost fixed and variable annuities in both personal and retirement accounts.”

You probably need three to five to 10 videos for each one of those topics or personas that you have. You might have one topic that somebody who is in their early twenties versus their early fifties, is looking at very, very differently.

Beyond the usual gestation period, here are some specific “trigger points” which plan sponsors have reacted to that have accelerated their decision to move into a PEP?