“Industry participants also argue that the rule transforms one-off transactions into fiduciary relationships in violation of the common law, but the common law of the states is divided on this, and there is a need for a federal standard regulating investment advice fiduciaries.”

Tag "IRA"

Here’s where the greatest controversy of the new Rule, as with its predecessors, comes to a head.

The process of transferring assets is not without its own liabilities. The exact nature of the fiduciary risk depends on the nature of the transfer.

If you have any experience in the retirement plan business, some predictions just write themselves. As in “an incredible feeling of déjà vu.”

Between the IRA Rollover matter and the redefinition of “regular services,” there is no shortage of ways to chip away at the new Rule. What might be one way we can expect to see the industry attack the Rule in front of a judge?

How strong an argument is there for auto-enrollment? Remember, the key feature of the 2006 Pension Protection Act was to encourage auto-enrollment. The SECURE Act has even stronger language.

This week is all about those wayward 401k features that are well beyond their expiration date. Careful, though. In the process, you’ll see what’s garbage to one is a work of art to another.

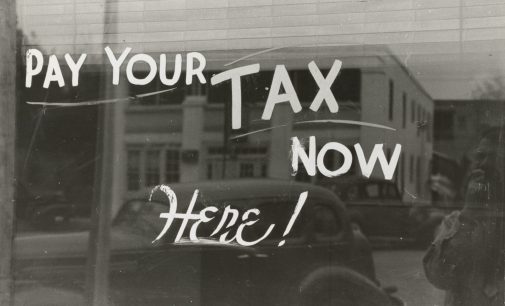

Here’s the irony of the tax saving incentive. If it’s wildly successful and leads to very large retirement accounts, the required minimum distributions at retirement may place the now retired employee in a higher tax bracket than the one experienced while working.

It’s critical that plan sponsors consult with compliance professionals before adding the Deemed IRA feature.

The Irony Of Taxing 401k Plans To Save Social Security

Worse, if the “alternatives” alluded to by the paper entail government backed programs like Social Security, this could have a debilitating impact on encouraging people to be responsible for funding their own retirement.