Here’s the irony of the tax saving incentive. If it’s wildly successful and leads to very large retirement accounts, the required minimum distributions at retirement may place the now retired employee in a higher tax bracket than the one experienced while working.

Tag "403b"

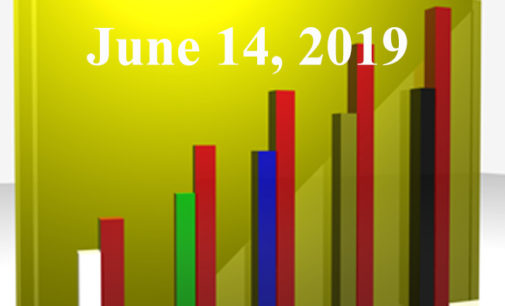

We asked retirement advisors from across the country whether they felt SECURE 2.0 had been over-hyped or represented a game changer. Here’s what they said on a few key issues.

Although the Rule appears to be directed primarily at service providers, plan sponsors still have a fiduciary duty to monitor plan compliance, and that includes complying with the demands of this new rule.

Before you start to panic, take a deep breath and relax. The retirement savings industry is an aircraft carrier. It can’t turn on a dime.

Compliance mixed bag, SEC BI DOA? and “Investments: The Sequel”

Retirement policy freak out, fiduciary rumbles, and “She Loves Fees” (yeah, yeah, yeah).

The Irony Of Taxing 401k Plans To Save Social Security

Worse, if the “alternatives” alluded to by the paper entail government backed programs like Social Security, this could have a debilitating impact on encouraging people to be responsible for funding their own retirement.