There’s always something new under the sun, and that means there’s always educational topics 401k plan sponsors should be asking about but aren’t. Hopefully, this list will inspire more curiosity and lead to better informed employees.

Education

The One Topic Every 401k Plan Sponsor Must Know Right Now: Fiduciary Education Curriculum (Part III)

Most 401k plan sponsors will readily admit they are not experts when it comes to retirement plans. They understand they have a role in the process. They understand that role carries with it certain fiduciary obligations. They understand (and accept) that role also exposes them to liabilities. This article shows how prudent delegation can mitigate much of that fiduciary liability.

The Meat and Potatoes Topics of 401k Plan Sponsor Training: Fiduciary Education Curriculum (Part II)

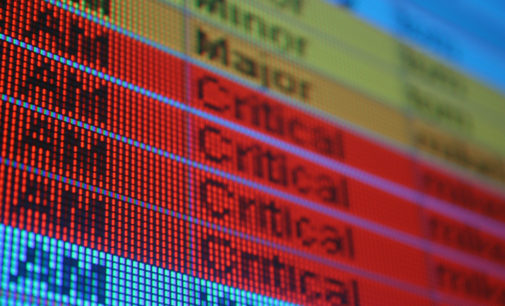

If we liken the “5 Critical Topics” to the skeleton and sinew of a plan sponsor’s fiduciary obligation, the “meat and potatoes” topics can be described as its soft underbelly. It is within the routines of these topics that plan sponsors live most dangerously. What are these next two topics and why is it important plan sponsors to dig deep into them rather than simply “read the headlines”?

These are fundamental in nature. They are necessary prerequisites for 401k plan sponsors to fully inculcate themselves with more complex topics.

With the final dust comfortably settling on this year’s tax season, we can know begin to put together the pieces of this new reality that may have plan sponsors and their service providers rethinking their long-held strategies.

Looking for an equal and opposite reaction for those intent on continued delays in saving for retirement? This article reveals 5 effective counter punches.

There’s no question 401k plan sponsors know they need to up their game when it comes to employee education programs. According to one study, 80% of education programs on 401k offerings for employees are ineffective. Plan sponsors today seek solutions to better engage employees.

There are two strategic paths to use when it comes reducing liability. One approach occurs after the fact – after the target date funds are already in place. The other approach takes place before the target date funds are even placed on the 401k plan menu. Which is more reliable?

When it comes to the definitive fiduciary, no one can play that role better than the parent. Parents constantly look out for their children. They want to give their children the best possible advantage to live a better life. Why not give them the ultimate head-start?

The Tax Cuts and Jobs Act preserved the sanctity of the treasured retirement contribution deduction – it even made it more important – but it also did a few things that might surprise some business owners.