Economic concepts can lay dormant for extended periods of time, but they never truly disappear. This is why it pays to know people who are older than you and have actually lived through one (or more) economic cycles.

Education

A family that plays together, saves together. Establishing a Child IRA benefits the next generation. Given its tremendous power, the Child IRA remains one of the most under-appreciated retirement savings tools available. In the remaining chapters, we’ll present a virtual “how-to” manual that shows how different groups of people can implement and enjoy the advantages of the IRA.

Long-term investors like retirement savers can easily act like a fiduciary for their own assets. All they need to do is look in a mirror – but not for their own reflection. Look in a mirror a retirement professional is looking into and see how that reflection invests for retirement.

There’s a chance for savers to increase the odds they’ll retire in comfort thanks to the 2017 tax law. Here’s how, but the window of opportunity will close fast.

With the introduction of the concept of anchoring, Tversky and Kahneman opened the door to a new way of thinking about and addressing the financial decision-making process. For more than four decades, subsequent research has expanded upon their idea. Yet, plan sponsors and participants continue to remain uninformed of the dangers of anchoring.

With a GOT-based strategy, expectations are predicated on needs, not the happenstance of the market. GOT-based portfolios may not have the record-breaking excitement of market indices, but it’s slow-and-steady-wins-the-race philosophy may lead to a more comfortable retirement.

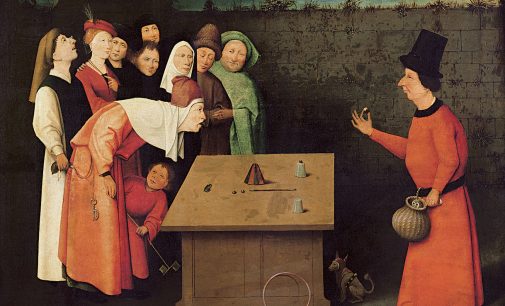

In retirement planning, there can never be any guarantees. That’s why it’s critical that these tools are used continually and consistently. A magician never gives the audience’s eyes a chance to wander.

Never belittle the question or the person asking the question. These are sincere queries that represent commonly held beliefs. These beliefs live a Schrodinger Cat-like existence, being generally not quite true and not quite false. It’s critical, for the benefit of all retirement savers, that these questions be asked and that fiduciaries encourage their asking. This is the only way that allows the fiduciary to respond in the second noteworthy way: By using these questions to refute misconceptions and promote good retirement saving decision-making.