Oddly the first question, the one asked from the plan sponsor’s perspective, came back with a slightly different answer (identifying appropriate investment options and then providing employee education regarding those options). This second question, from the professional fiduciary’s outlook, adds a bit of emphasis on fees. Are the different responses significant? Is the similarity in responses a problem?

Education

That’s what a new education can focus on. Instead of the same-old-same-old of emphasizing “saving early and often,” education should think past the sale.

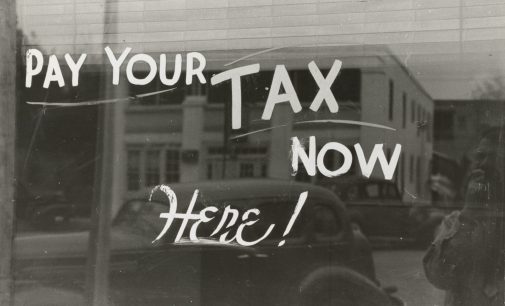

Here’s the irony of the tax saving incentive. If it’s wildly successful and leads to very large retirement accounts, the required minimum distributions at retirement may place the now retired employee in a higher tax bracket than the one experienced while working.

Retirement plan sponsors may also benefit from teaching entrepreneurial skills to their employees. Such lessons could also provide employees with opportunities to begin to practice what they learned directly for their current employer.

It’s critical that plan sponsors consult with compliance professionals before adding the Deemed IRA feature.

The story arc of the 401k mimics that of software. Each release adds to and builds on features and benefits over and above those of previous releases.

It might suit 401k plan sponsors and fiduciaries to tell this story of the generations to help the next generation avoid the mistakes of past generations. This tale provides many good tips about the dangers of investing in extremes, be they too conservative or too aggressive.

There is an out, of course, but that might eliminate the so-called “institutional pricing” advantage former employees have for staying in the plan in the first place.

While retirees and near-retirees may be considering starting a small side business, many don’t have any entrepreneurial experience. How might they find answers to the questions they have?