If you’re over fifty, that gold watch gleams closer and closer. You start thinking. You start wondering. You start asking questions.

Education

To address this requires employers to do more than having a periodic “employee education” meeting. While these can help (see the previous article), more need to be done. Plan sponsors need to consider how they (and, more importantly, their service providers) deliver messages to plan participants.

Not only does the typical plan sponsor not have investing in employee education as a high priority, but they also likely don’t have the wherewithal to monitor the consistency of how the provider runs the education program.

How do you solve, for example, the problem of integration between the payroll software and the 401k recordkeeper’s website?

A few years ago, this might have been classified as a common “mistake.” Again, “mistake” is in quotes because this is less an issue for certain plans (usually small firms or particular industries) than others.

But this rookie mistake doesn’t bypass veteran plan sponsors. If they’ve grown too complacent with their plan, they may wake up one day to find out they’ve got a dinosaur on their hands.

Retirees should think for themselves and what alternatives they have regarding their retirement assets. These aren’t the same as they were when they were working.

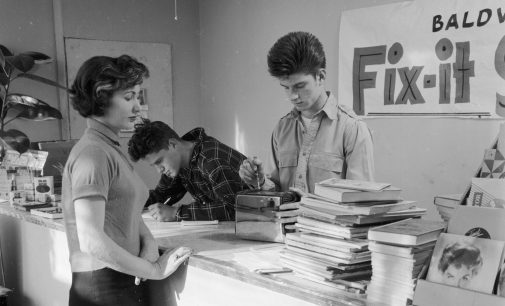

As with many things, hands-on instruction is generally the best way to achieve this, especially if you make it into an engaging workshop that’s all about the employee and the employee’s dreams, not about the plan.

Those who work with retirees and people saving for retirement often have the best perspective when it comes to guidance pertaining to what is comfortable and what is not. It begins with a very simple definition.