This doesn’t mean you shoot haphazardly for the stars when you can have the moon. After all, you’ve got to know your limitations. Seeking unreachable goals will only make your retirement seem hollow and pointless.

Plan Sponsors

Today, more and more plan providers are thinking “inside the box,” trying to spice up employee meetings by throwing a good dose of entertainment in with the education.

There’s a perverse incentive working here, however. The more aggressive a plan sponsor gets in terms of promoting “financial wellness,” the more likely that plan sponsor will accidentally cross some compliance line.

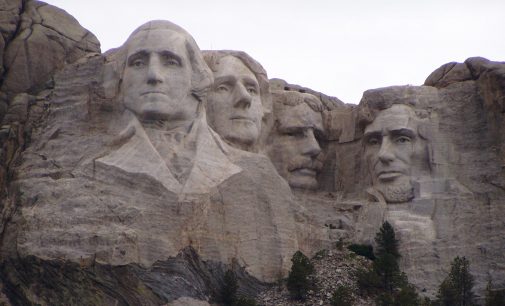

“Honest Abe” earned his nickname very early in life. In fact, perhaps the most famous narrative defines the very nature of fiduciary loyalty. And, of course, it deals with the flow of and caretaking of pecuniary assets. In this manner, Lincoln, more than Washington, better represents the modern ERISA fiduciary.

What would it take to realize the fiduciary liability of overtly using “risk tolerance” metrics? And what can 401k plan sponsors do about it?

It’s not necessarily something that can be done at the flick of a switch, but it can be baked into the process.

If a company sees a substantial number of employees exit their firm, this can have a detrimental impact on all areas. Even the company’s 401k can be negatively affected in a number of ways.

The decision to retain and service company retirees appears (at first blush at least) to be a no-brainer. But that includes a very important assumption.