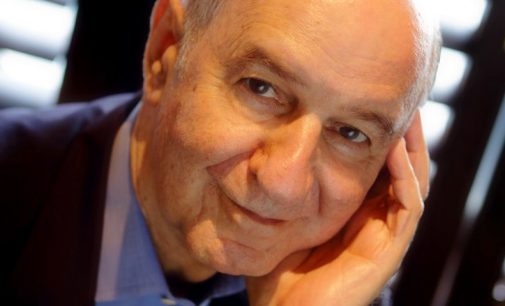

A major retirement industry thought leader collects his gold watch. Here’s his inside story. And he’s sticking to it.

Interviews

“I was [once] a major skeptic of the use of annuities, I have subsequently changed my mind regarding the efficacy of low-cost fixed and variable annuities in both personal and retirement accounts.”

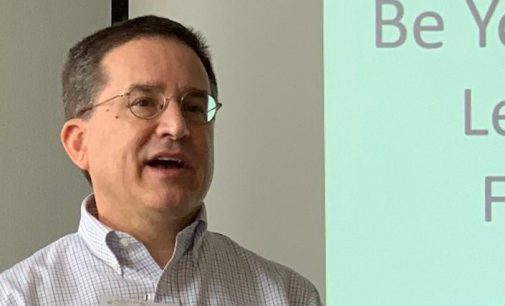

You probably need three to five to 10 videos for each one of those topics or personas that you have. You might have one topic that somebody who is in their early twenties versus their early fifties, is looking at very, very differently.

Beyond the usual gestation period, here are some specific “trigger points” which plan sponsors have reacted to that have accelerated their decision to move into a PEP?

How do we design and administer retirement plans?

In theory, 401k plans were always intended to be highly portable, but that’s not what happened. “Portability” only evolved to the extent that the most-attractive balances were picked off and rolled over to IRAs, and everyone else was left holding the bag.

Why are there two kinds of Target Date Funds and why does that doom this particular group of people saving for retirement in their company’s 401k plan?

When is a “problem” not really a problem? And what can be better than success, even if no one knows about it.

“Encouraging lifetime income distributions was one of my major initiatives at DOL and my biggest regret was that I was not able to move the ball forward as much as I wanted during my time there.” Here she explains why.