The height of absurdity was in 2017, when Long Island Ice Tea Corp changed its name to Long Blockchain Corp and its shares soared.

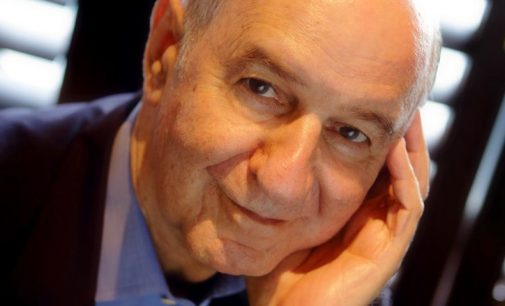

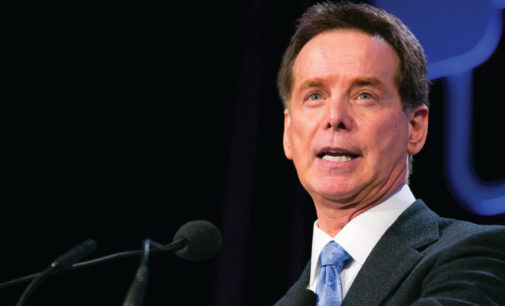

Interviews

Here’s an inside look at what’s been making all those headlines the last few years, and maybe what might be making headlines in the next few years.

“The ruling by the First Circuit in the Putnam case further increases focus on trust law when determining the scope of fiduciary responsibility under ERISA. Prudent practice already draws on trust law and sometimes prudent practice is ahead of the courts.”

Why are financial professionals more likely to embrace behavioral finance and how can this help the average investor?

If we understand thoroughly what happened to each generation during its unique formative years, we can then make sense of the unique and powerful core values that guide that generation’s unique decision-making, including the decisions about their money.

“Pick a lane… please. Why is the SEC living in the land of ambiguity? Lead, follow, or step aside. I may not agree with Ken Fisher very often but on this point, I believe he nailed it…”

“…anytime we are talking about disclosures, don’t make them like the lovely 404a notices. Make them simple and easy to understand. Otherwise you lose the whole point of the disclosure.”

Before one can advise investors, it’s critical one know what they’re thinking and understand why they’re thinking it.