For 8 years as Assistant Secretary of EBSA, Phyllis Borzi fought vigorously to protect plan sponsors and retirement savers under the uniform fiduciary umbrella. Here, she answers questions about the past, present and future of the Fiduciary Rule.

Interviews

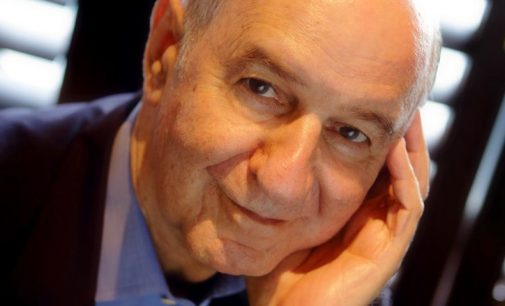

One of the nation’s top ERISA attorneys tells us even if the Fiduciary Duty is dead, it’s not. The only question is which part will remain alive and which part with wither on the vine. Fred Reish has an idea, and he tells us here.

Prolific ERISA attorney shares his views on the DOL’s Fiduciary Rule and the direction the industry is headed in.

“This uncertainty can be very challenging for plan sponsors. If I have to give some basic words of advice to plan sponsors, I simply say ‘stop and take a breath.’”

“There is no practical difference between ‘adviser’ and ‘advisor’ in the eyes of the customer. Both suggest a level of relationship well beyond the standard of a brokerage relationship.”

I am behind any idea that puts savings on autopilot and takes a lot of thought out of it. Take for example every time we get a raise in our salary. We should automatically have our savings contributions adjust accordingly when that happens.

“Casting a wider investment net on asset classes and alternative strategies, especially those that are designed to reduce risk, as increasing a sponsor’s fiduciary liability. That seems to be the misnomer, that the term ‘alternatives’ assimilates to higher risk or higher cost investments.”

The primary reasons for small businesses that you don’t offer 401k plans are cost, complexity, and liability exposure. The traditional 401k plan has a lot of baggage rolled to those areas. It’s complicated. It’s definitely not easy. For local business of 10 to 15 employees that have so many different things they have to deal with, they just aren’t in position to want to have to deal with the baggage with the 401k plan.

Benna expertly explains why small businesses face nearly insurmountable obstacles when it comes to establishing a 401k, America’s preferred retirement savings vehicle. He then shows how to re-frame existing retirement plan vehicles in a way that small business owners and employees will find more appealing.