Between the IRA Rollover matter and the redefinition of “regular services,” there is no shortage of ways to chip away at the new Rule. What might be one way we can expect to see the industry attack the Rule in front of a judge?

Tag "DOL"

This broader definition of fiduciary may impose a potential hardship on a segment of the retirement industry that has been trying hard to gain a foothold in plan infrastructure.

The DOL seems to use the same metric that it earlier employed in its statement on the Fiduciary Rule. Still, the Advisory Opinion is very precise in what it allows. Citi will have to tread carefully to not cross the line into the realm of fiduciary.

The DOL’s guidance on missing plan participants appears just as effective as its week 2012 Mutual Fund Fee Disclosure Rule. Yes, it’s there, but it has no viability. Still, that doesn’t mean 401k plan sponsors can ignore the issue, even if they have not lost participants.

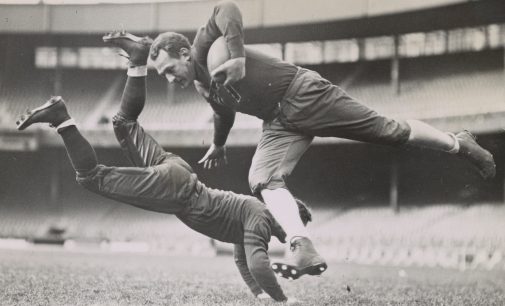

The antiseptic compliance regime spelled out by the DOL and ERISA has to date defined fiduciary services. Perhaps, if we’re going to consider what is “beyond” that sterile definition, we might want to go back to the future. In a sense, rediscovering where “fiduciary” initially came from might suggest where it is headed.

Back then, at least, we knew who wore the white hats and who whore the black hats. Today, thanks to muddled and often conflicting regulations for multiple agencies, everyone is wearing fifty shades of gray.

This week we’ll be focusing on those favorite features as judged by the retirement plan professionals we interviewed. Don’t be surprised if over the next few weeks you discover that one provider’s treasure is another provider’s trash.

The root of these broader fiduciary concerns lies within the domain of compliance. Everything derives from what the regulators require, what any DOL audit might look at, and what might pique the interest of class-action attorneys.

The Biden Rule, like the Trump Rule, does not encourage or discourage the use of ESG criteria when selecting investments. This allows fiduciaries to either adopt ESG principles or ignore them.

It’s critical that plan sponsors consult with compliance professionals before adding the Deemed IRA feature.