Cunningham v. Cornell is testing whether traditional 401k fiduciary compliance truly protects plan sponsors. Courts and regulators are probing governance gaps, personal liability, and participant harm more aggressively than ever.

Tag "liability"

In many small employer 401k plans, those pressures combine with poor vendor selection, weak oversight, and minimal participant education to create environments where employees pay more and get less.

Risk capacity anchors 401k advice in hard data—income stability, net worth, liquidity, and retirement timeline. Unlike tolerance, which shifts with market moods, capacity reflects what participants can afford to lose, aligning with ERISA’s fiduciary duties.

Viewing this content requires a Basic (Free) Membership or better. You are not currently logged in. If you have an

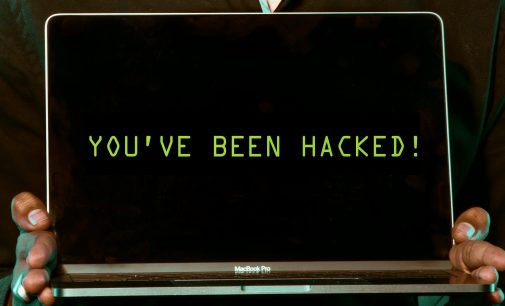

The moments immediately following the detection of a cyber incident are crucial. Prompt containment limits damage, prevents data loss, and fortifies plan stability. A rapid protocol turns confusion into control, helping fiduciaries avoid ERISA liability and maintain operational stability.

Breaches hit fast. Fiduciaries must be ready to act. A documented incident response plan—including who to notify, how to contain the breach, and when to report it—is vital for 401k cyber protection. It demonstrates prudence and minimizes chaos.

Documenting the evaluation process helps protect against potential legal challenges. By proactively managing these red flags, fiduciaries can responsibly integrate private equity into 401k plans and reduce ERISA compliance concerns.

5 Underreported 401k Stories From The Summer Of 2025

Not all impactful changes come from courtrooms or market forecasts. Sometimes the quietest adjustments happen in the administrative framework of retirement plans. This summer, two such moves stood out as underreported 401k stories that carry both promise and peril for fiduciaries.