These are fundamental in nature. They are necessary prerequisites for 401k plan sponsors to fully inculcate themselves with more complex topics.

Tag "liability"

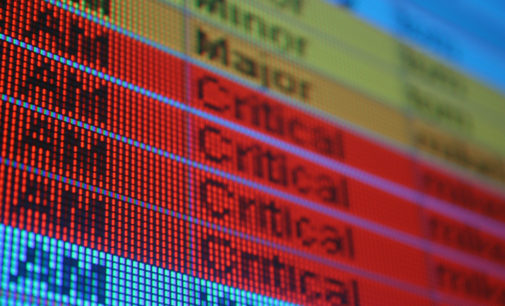

Here’s an inside look at what’s been making all those headlines the last few years, and maybe what might be making headlines in the next few years.

There are two strategic paths to use when it comes reducing liability. One approach occurs after the fact – after the target date funds are already in place. The other approach takes place before the target date funds are even placed on the 401k plan menu. Which is more reliable?

When retirement industry professionals talk about the impact of the 2006 Pension Protection Act, you might be surprised that this is what they conclude.

The need for 401k plan sponsors to increase their focus on their fiduciary duties and, specifically, execute strategies with can reduce their fiduciary liability, arises from this New Fiduciary Era in which we find ourselves. Fortunately, the path to implementing these strategies is well worn. It should be easy to accomplish.

It’s safer to assume you don’t know everything – and here’s a list that begins to define that everything.

FiduciaryNews.com Trending Topics for ERISA Plan Sponsors: Week Ending 10/5/18

Compliance Do-Overs, Fiduciary Momentum, and “Free” lunches.