In many small employer 401k plans, those pressures combine with poor vendor selection, weak oversight, and minimal participant education to create environments where employees pay more and get less.

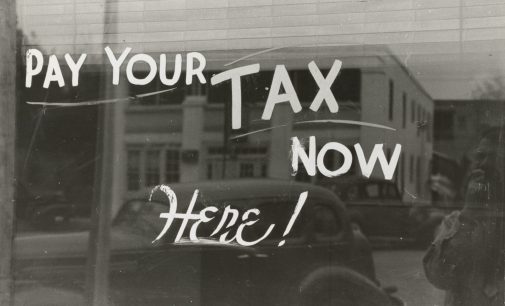

Tag "IRS"

Making matters worse is the changing regulatory environment once the new SECURE Act 2.0 rules become effective. The good news is the dust settles after that.

The relative quickness of this one-two shot from the District Courts suggests an obvious flaw in the new Rule.

The DOL’s guidance on missing plan participants appears just as effective as its week 2012 Mutual Fund Fee Disclosure Rule. Yes, it’s there, but it has no viability. Still, that doesn’t mean 401k plan sponsors can ignore the issue, even if they have not lost participants.

This week we’ll be focusing on those favorite features as judged by the retirement plan professionals we interviewed. Don’t be surprised if over the next few weeks you discover that one provider’s treasure is another provider’s trash.

Here’s the irony of the tax saving incentive. If it’s wildly successful and leads to very large retirement accounts, the required minimum distributions at retirement may place the now retired employee in a higher tax bracket than the one experienced while working.

It’s critical that plan sponsors consult with compliance professionals before adding the Deemed IRA feature.

There is an out, of course, but that might eliminate the so-called “institutional pricing” advantage former employees have for staying in the plan in the first place.

Before you get all excited and look to replace your home equity loan with a 401k loan, you should consider these things.