Between the IRA Rollover matter and the redefinition of “regular services,” there is no shortage of ways to chip away at the new Rule. What might be one way we can expect to see the industry attack the Rule in front of a judge?

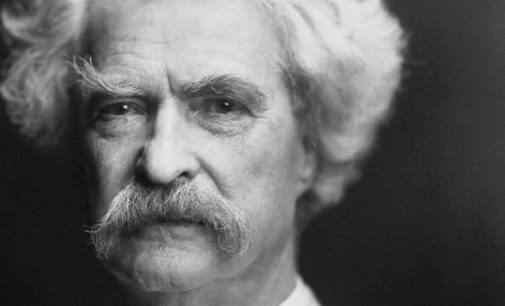

Tag "Matthew Eickman"

This broader definition of fiduciary may impose a potential hardship on a segment of the retirement industry that has been trying hard to gain a foothold in plan infrastructure.

The Biden Rule, like the Trump Rule, does not encourage or discourage the use of ESG criteria when selecting investments. This allows fiduciaries to either adopt ESG principles or ignore them.

Nobody’s perfect. It’s unfair to expect recordkeepers to be. Everyone makes mistakes—even recordkeepers. The problem is what happens when a mistake occurs.

How do you solve, for example, the problem of integration between the payroll software and the 401k recordkeeper’s website?

A few years ago, this might have been classified as a common “mistake.” Again, “mistake” is in quotes because this is less an issue for certain plans (usually small firms or particular industries) than others.

But this rookie mistake doesn’t bypass veteran plan sponsors. If they’ve grown too complacent with their plan, they may wake up one day to find out they’ve got a dinosaur on their hands.

Among the tactics introduced by behavioral finance is the notion of “framing.” For individuals, however, it’s much easier to understand things if they are reframed into “buckets” representing specific individual goals.

The conflicts-of-interest inherent in selecting proprietary funds are apparent. Less so are the criteria used to determine what a suitable process might be.

The decision to retain and service company retirees appears (at first blush at least) to be a no-brainer. But that includes a very important assumption.