Participation is one thing. It’s critical that retirement savers build on the momentum of participation and use that to increase the amount of dollars that get contributed to their article. How can plan sponsors facilitate this?

Tag "retirement"

These service providers bring in expertise and can engage the worker directly. Once set in place, the plan sponsor can step aside and let the system run on its own.

The twist is this: The bad news is only a fraction of the people will be able to save $4.3 million for retirement because the average salary is too low. The good news is most people won’t need to save $4.3 million because, thanks to living on a low average salary, they are accustomed to spending far less.

The key intent of this strategy is to allow freedom to and reward long-term employees who have accumulated the skills the company needs to compete.

So what if a few very high net savers end up with bigger retirement plans? Good for them. The point is to make it easier for more people to save more.

Well, if we’re thinking outside the box, why not go big? It turns out, retirement planning isn’t just about accumulating sources of future funds.

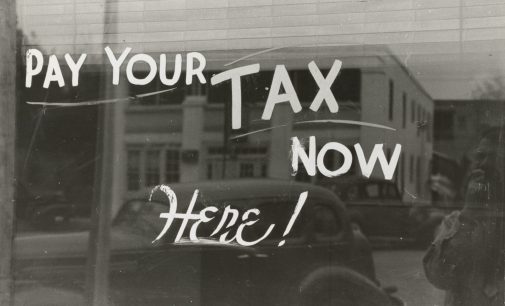

Here’s the irony of the tax saving incentive. If it’s wildly successful and leads to very large retirement accounts, the required minimum distributions at retirement may place the now retired employee in a higher tax bracket than the one experienced while working.

Retirement plan sponsors may also benefit from teaching entrepreneurial skills to their employees. Such lessons could also provide employees with opportunities to begin to practice what they learned directly for their current employer.