It’s too easy for plan sponsors to get lost in the weeds when dealing with plan minutia. Yes, “the buck stops here” reality can overwhelm many. Delegation is the key. It’s also the Achilles Heel. This is where the magic word emerges.

Tag "Richard Bavetz"

For all the good intentions, however, what will happen when the rubber finally meets the road? Will the new DOL Fiduciary Rule really level the playing field?

Here’s where the greatest controversy of the new Rule, as with its predecessors, comes to a head.

For all the rose-colored eyes that have a created a legend flawless certitude concerning memories of a time that never existed, pension plans simply can’t measure up to 401k plans.

Herein lies the potential for a direct conflict of interest. This applies generally to all proxy voting in commingled portfolios.

All kidding aside, Valentine’s Day is more than cards, candy, and Cupid. It’s about renewing a vow to treat each other with the highest fiduciary standard.

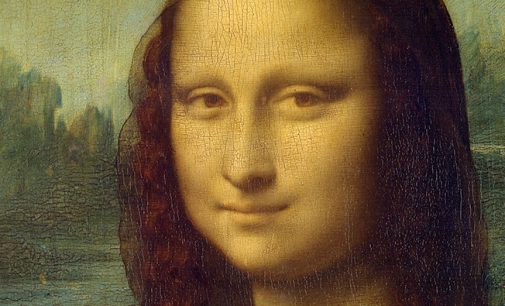

These Classic Movies (Unknowingly?) Promote The Fiduciary Standard

It seems like each decade produces a major box office hit that exudes fiduciary. This whole “best interest” thing seems to have caught on in Tinseltown. More recent movies have added a good dose of the “honesty” part of fiduciary.