Here the intent is to make it possible for a plan/IRA to apply the QDIA safe harbor to involuntary rollovers. But how will this impact plan participants?

Tag "Rollover"

Here’s where the greatest controversy of the new Rule, as with its predecessors, comes to a head.

The process of transferring assets is not without its own liabilities. The exact nature of the fiduciary risk depends on the nature of the transfer.

How do we design and administer retirement plans?

In theory, 401k plans were always intended to be highly portable, but that’s not what happened. “Portability” only evolved to the extent that the most-attractive balances were picked off and rolled over to IRAs, and everyone else was left holding the bag.

The decision to retain and service company retirees appears (at first blush at least) to be a no-brainer. But that includes a very important assumption.

Two opposing forces, what does “fiduciary” really mean, and, speaking of conflicts-of-interest.

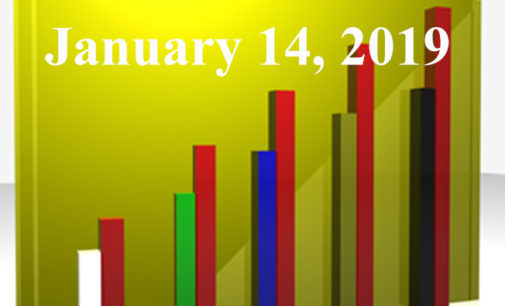

FiduciaryNews.com Trending Topics for ERISA Plan Sponsors: Week Ending 3/29/19

Compliance mixed bag, SEC BI DOA? and “Investments: The Sequel”