Here’s the irony of the tax saving incentive. If it’s wildly successful and leads to very large retirement accounts, the required minimum distributions at retirement may place the now retired employee in a higher tax bracket than the one experienced while working.

Tag "SEP-IRA"

Just because you don’t have a fiduciary duty to other employees doesn’t mean you shouldn’t continue to think like a fiduciary.

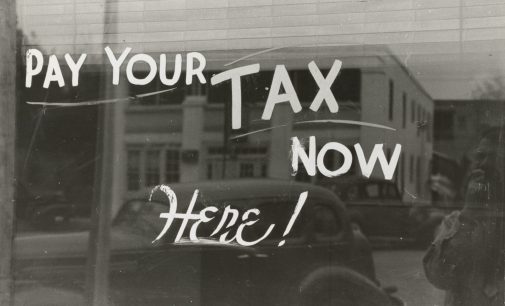

If you own a business, waiting until the last minute to reduce taxes limits your options. You still have some, though. Here they are.

Tax your retirement plan? 12b-1 fees don’t work? SEC opens Fiduciary Standard cost comment period? and more!

FiduciaryNews Trending Topics for ERISA Plan Sponsors: Week Ending 3/7/14

IRA Rollover Worries, 401k fee misfire and ODing on indexing.