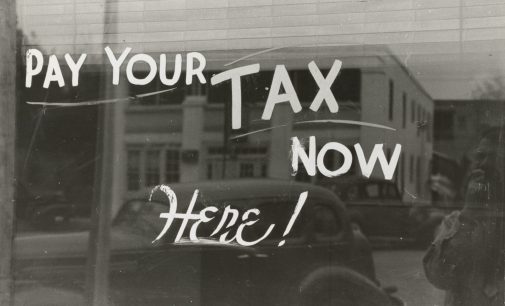

Laffer postulated that tax receipts might be increased by reductions in the tax rate because such reductions would bring people out of the underground economy and also reduce the usage of tax shelters. This advice was implemented in President Ronald Reagan’s “Reaganomics,” and it worked to increase tax revenues.

Tag "tax"

This week we’ll be focusing on those favorite features as judged by the retirement plan professionals we interviewed. Don’t be surprised if over the next few weeks you discover that one provider’s treasure is another provider’s trash.

Here’s the irony of the tax saving incentive. If it’s wildly successful and leads to very large retirement accounts, the required minimum distributions at retirement may place the now retired employee in a higher tax bracket than the one experienced while working.

Before you get all excited and look to replace your home equity loan with a 401k loan, you should consider these things.

The problem with Sequence of Return Risk is that there’s no way of knowing if you’ll experience it. It’s a roll of the dice. The best way to avoid this risk is to prepare as if it were going to happen.

Long industry veteran tells it like it is. How will his comments change your thoughts on these important subjects?

Before you start to panic, take a deep breath and relax. The retirement savings industry is an aircraft carrier. It can’t turn on a dime.

This isn’t free money. It comes at a price. Many naïve folks might be salivating at the prospect of releasing these big bucks from the prison of their retirement plan… until they read the fine print.

FiduciaryNews.com Trending Topics for ERISA Plan Sponsors: Week Ending 5/24/19

SECURE Act recap, BI coming, and ESG sizzling.