Today, in reading some of the headlines, you’d think they’re greater than sliced bread. They may be. They may not be. Still, there are differences, and 401k plans sponsors would benefit from practicing the utmost in due diligence when determining if CITs are the right fit for their plan.

If the numbers don’t add up for annuities (or anything else, for that matter), where is the demand for these products coming from?

DOL on a roll, back to the fiduciary egg, and why the sudden interest in fees?

There’s not a sin in listening to radio shows sponsored by those selling gold and silver. It’s quite another thing to actually act on their “recommendation.”

Active regulators, chickens roosting at home, and stretching investments.

Should the platform offer ESG doesn’t necessarily mean good news for the 401k plan sponsor. Including ESG funds might introduce other risks.

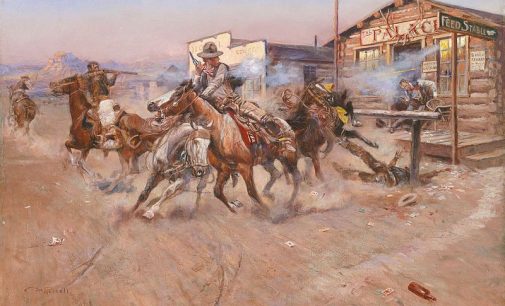

Unbelievable reg claims, unbelievable fiduciary aims, unbelievable stock maims.

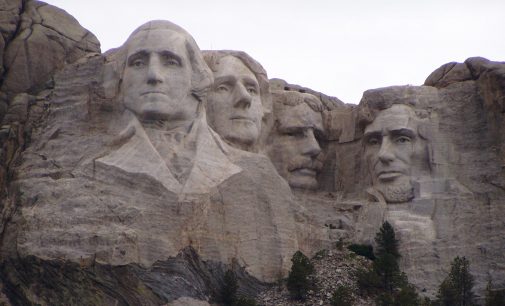

“Honest Abe” earned his nickname very early in life. In fact, perhaps the most famous narrative defines the very nature of fiduciary loyalty. And, of course, it deals with the flow of and caretaking of pecuniary assets. In this manner, Lincoln, more than Washington, better represents the modern ERISA fiduciary.

DOL Rule Fight, Un-Safe Harbor, and Ben Graham = Godot?

FiduciaryNews.com Trending Topics for ERISA Plan Sponsors: Week Ending 3/18/22

RMDS, retirement age & scams, new reasons for fiduciaries to worry, and predicting bad predictions.