Today, in reading some of the headlines, you’d think they’re greater than sliced bread. They may be. They may not be. Still, there are differences, and 401k plans sponsors would benefit from practicing the utmost in due diligence when determining if CITs are the right fit for their plan.

Basic Members

If the numbers don’t add up for annuities (or anything else, for that matter), where is the demand for these products coming from?

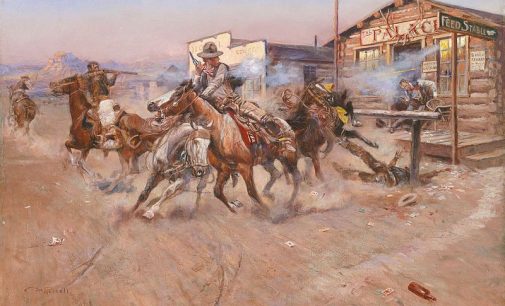

There’s not a sin in listening to radio shows sponsored by those selling gold and silver. It’s quite another thing to actually act on their “recommendation.”

Should the platform offer ESG doesn’t necessarily mean good news for the 401k plan sponsor. Including ESG funds might introduce other risks.

“Honest Abe” earned his nickname very early in life. In fact, perhaps the most famous narrative defines the very nature of fiduciary loyalty. And, of course, it deals with the flow of and caretaking of pecuniary assets. In this manner, Lincoln, more than Washington, better represents the modern ERISA fiduciary.

Normally, interest rates rise with inflation. In turn, bond rates rise with interest rates. But that hasn’t happened. In fact, short rates remain at historic lows. This means folks sitting in money markets or “safe” government bonds (and bond funds) are seeing their retirement savings eroded away.

If you’re a fiduciary of the acquiring plan, you want to make sure you’re not burdened with any unknown liabilities. If you’re a fiduciary of the acquired plan, you want to make sure the merger process doesn’t introduce new liabilities.

What would it take to realize the fiduciary liability of overtly using “risk tolerance” metrics? And what can 401k plan sponsors do about it?

The conflicts-of-interest inherent in selecting proprietary funds are apparent. Less so are the criteria used to determine what a suitable process might be.

Beyond the usual gestation period, here are some specific “trigger points” which plan sponsors have reacted to that have accelerated their decision to move into a PEP?