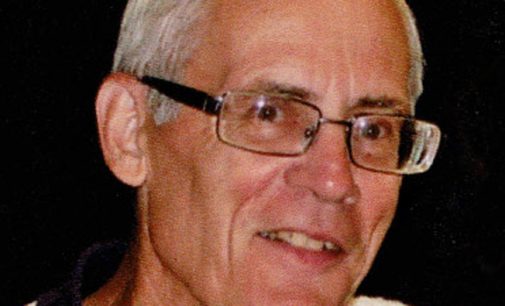

If you want to understand how sophisticated plan sponsors think, you need to talk to sophisticated plan sponsors. For many years, Dale Neibert served as part of a two-man operation that headed one of the nation’s most sophisticated 401k plans. He explains how this plan sponsor incorporated advance behavioral finance techniques, and how it avoided some of today’s most dangerous fads.

Tag "auto-enrollment"

With the pain of the Target Date Fund 2008/09 market crash debacle still lingering in the mind, to best assess the potential fiduciary liability inherent in TDFs – no matter what safes harbors were promised by the PPA – it’s critical that 401k plan sponsors understand what’s good about them, what’s bad about them, and just why they’re so popular.

Ted Benna says ERISA/PBGC – not the 401k – killed pension plans and that pensions no longer make sense given our current job-hopping demographics. He also says a lot more in this must read interview.

Millennial-Centric Retirement Policy, Fiduciary by any other name, and Why the latest Fiduciary Rule fee move shouldn’t surprise you.

Dire prediction for Social Security, when it rains it pours (for fees), and two sides of the same investment coin.

Insane compliance, a whole new fiduciary world, and bad news for index funds

Viewing this content requires a Basic (Free) Membership or better. You are not currently logged in. If you have an

Simpler is better, the Fiduciary Paradox, and volatility isn’t risk.

Failing to learn from history, Fiduciary Rule shortcuts, and back to investing basics.

Vote in our Poll

Government Resources

- DOL: elaws – ERISA Fiduciary Advisor

- DOL: Fiduciary Education Campaign: Getting It Right – Know Your Fiduciary Responsibilities

- DOL: Getting Ready for Changes In Filing Your Plan’s Annual Return/Report Form 5500

- DOL: Meeting Your Fiduciary Responsibilities

- DOL: Reporting and Disclosure Guide for Employee Benefit Plans

- DOL: Selecting An Auditor For Your Employee Benefit Plan

- DOL: Selecting And Monitoring Pension Consultants

- DOL: Tips For Selecting And Monitoring Service Providers For Your Employee Benefit Plan

- DOL: Understanding Retirement Plan Fees And Expenses

- DOL: What You Should Know About Your Retirement Plan

FiduciaryNews.com Trending Topics for ERISA Plan Sponsors: Week Ending 12/23/16

Why not State Plans, fiduciary crowd-sourcing, and fee rewind.