The prevailing consensus has been corporate executives work for their owners (i.e., shareholders). That all changed on August 19, 2019. What are the fiduciary implications?

Tag "SEC"

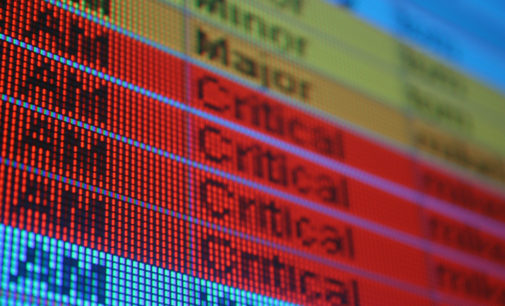

Regulators (including the DOL) seem intent on splitting the baby in half by allowing two incompatible business models – one fiduciary with no self-dealing fees, the other non-fiduciary with conflict-of-interest fees – to coexist within the same market. Does this mean “fiduciary” has lost its inherent advantage?

Was “fiduciary” done in by over-saturation? Or was it the victim of a super successful negative campaign? Or is there something missing in our analysis?

SEC’s best interest, ERISA’s fiduciary, and through the floor on fees.

SECURE Act recap, BI coming, and ESG sizzling.

These are fundamental in nature. They are necessary prerequisites for 401k plan sponsors to fully inculcate themselves with more complex topics.

Here’s an inside look at what’s been making all those headlines the last few years, and maybe what might be making headlines in the next few years.

FiduciaryNews.com Trending Topics for ERISA Plan Sponsors: Week Ending 6/14/19

SECURE, BI, and 3% fees!