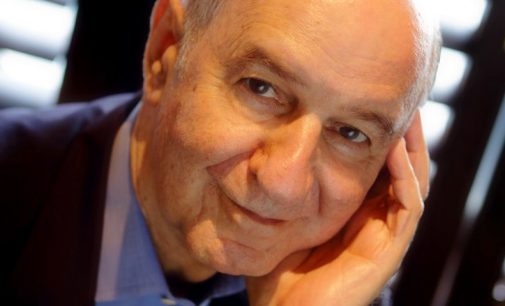

“I was [once] a major skeptic of the use of annuities, I have subsequently changed my mind regarding the efficacy of low-cost fixed and variable annuities in both personal and retirement accounts.”

Posts From Christopher Carosa, CTFA

A few years ago, this might have been classified as a common “mistake.” Again, “mistake” is in quotes because this is less an issue for certain plans (usually small firms or particular industries) than others.

Compliance learning, same old fee mistakes, and ESG gets a cold fiduciary slap on the face!

Closer to the target, (it turns out) size doesn’t matter, and more on fading fads.

But this rookie mistake doesn’t bypass veteran plan sponsors. If they’ve grown too complacent with their plan, they may wake up one day to find out they’ve got a dinosaur on their hands.

DOL at work, revenue sharing in the sites, and popular investing tropes under attack.

Among the tactics introduced by behavioral finance is the notion of “framing.” For individuals, however, it’s much easier to understand things if they are reframed into “buckets” representing specific individual goals.

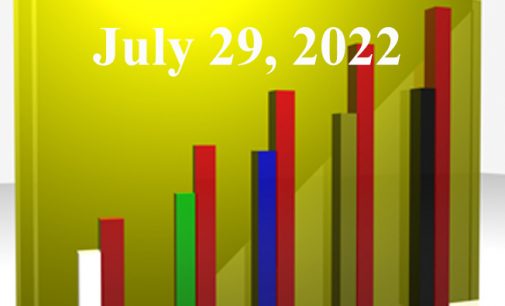

Compliance potpourri, fees again, and market wild craziness.

FiduciaryNews.com Trending Topics for ERISA Plan Sponsors: Week Ending 8/19/22

Everything under the regulatory sun, real fees In court, and don’t believe everything you read.