With a GOT-based strategy, expectations are predicated on needs, not the happenstance of the market. GOT-based portfolios may not have the record-breaking excitement of market indices, but it’s slow-and-steady-wins-the-race philosophy may lead to a more comfortable retirement.

Posts From Christopher Carosa, CTFA

All the preceding reasons logically lead to this one undeniable truth: You either meet your goal or you don’t. All other methods of measurement, all other forms of calculations, all other arbitrary comparisons fail to stand up to this simple, common-sense, metric.

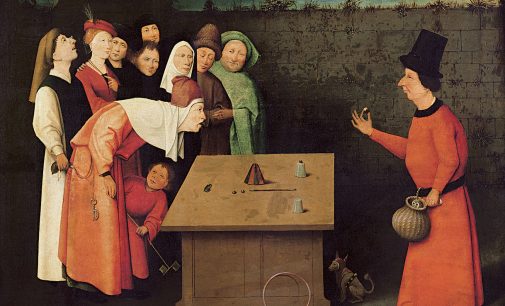

In retirement planning, there can never be any guarantees. That’s why it’s critical that these tools are used continually and consistently. A magician never gives the audience’s eyes a chance to wander.

Never belittle the question or the person asking the question. These are sincere queries that represent commonly held beliefs. These beliefs live a Schrodinger Cat-like existence, being generally not quite true and not quite false. It’s critical, for the benefit of all retirement savers, that these questions be asked and that fiduciaries encourage their asking. This is the only way that allows the fiduciary to respond in the second noteworthy way: By using these questions to refute misconceptions and promote good retirement saving decision-making.

“Casting a wider investment net on asset classes and alternative strategies, especially those that are designed to reduce risk, as increasing a sponsor’s fiduciary liability. That seems to be the misnomer, that the term ‘alternatives’ assimilates to higher risk or higher cost investments.”

Government gangsters, boxers, and fee mongers.

Be careful what you wish for because sometimes the cure can be worse than the disease.

Horse trading, sales/advice, and market tops.

FiduciaryNews.com Trending Topics for ERISA Plan Sponsors: Week Ending 12/1/17

New thinking, delay of game, and moving (too far?) ahead.