Discover cryptocurrency basics, from Bitcoin’s origins to its role in modern finance. Explore how crypto could reshape 401k investing with expert insights.

Interviews

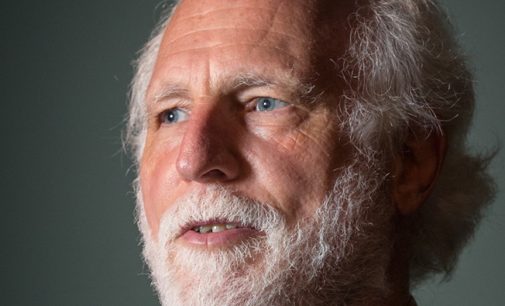

Think of the third party as the food truck in the parking lot. Employees will see it and decide for themselves whether to engage with it.

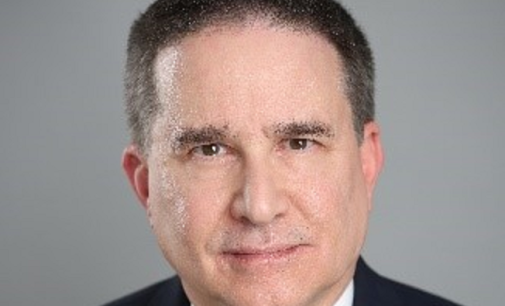

I do not underestimate the ability of the plaintiff’s bar to come up with novel and clever arguments, but for the reasons set forth in the white paper I do not believe that they can construct a viable theory.

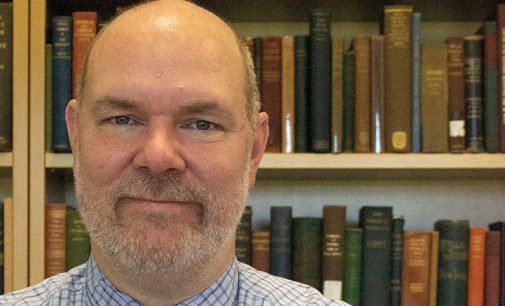

Honestly, I think most 401k plans are off-the-shelf items bought from the large asset management companies, purchased by executives who want to get rid of the vexing chore of setting up a retirement plan that benefits the employees.

Among the consequences that can follow from the Supreme Court’s overruling Chevron is yet more situations for which an answer to a question of law won’t be one bright-line rule made by a government agency.

“Industry participants also argue that the rule transforms one-off transactions into fiduciary relationships in violation of the common law, but the common law of the states is divided on this, and there is a need for a federal standard regulating investment advice fiduciaries.”

“This lack of active involvement could lead to inefficiencies, reduced liquidity, and potential market instability, as prices may not accurately reflect the underlying value of securities.”

I don’t think the plan service providers should provide participant advice. Advice to participants should be provided by a non-related third-party fiduciary.

Should 401k plans allow participants to take loans from their retirement savings accounts? Is pre-retirement access to 401k assets constructive or destructive?

“The ERISA plaintiffs’ bar has overlooked the potential value of the Restatement’s prudent investor rule and its application to litigation involving 401k plans.”