How can fiduciaries bridge the generational divide in 401k communication without inviting ERISA scrutiny? The strategies that follow may prove transformational.

Tag "Compliance"

The central role of the recordkeeper can create reverberations with other providers should the plan sponsor attempt to change recordkeepers. Any hiccup in the employees’ ability to manage their retirement assets can cause problems for plan sponsors.

There’s a perverse incentive working here, however. The more aggressive a plan sponsor gets in terms of promoting “financial wellness,” the more likely that plan sponsor will accidentally cross some compliance line.

It’s a tale of two regulators. One wants to play politics while the other wants to accomplish something. Meanwhile, ETFs continue to get mixed reviews.

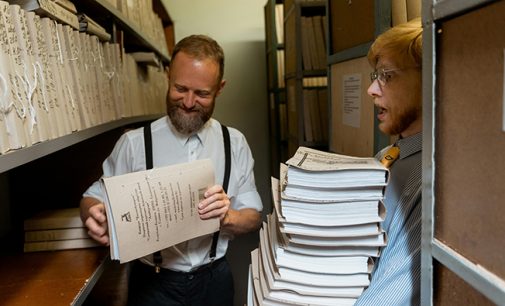

Here’s your chance to see a real example of the new DOL 401k Disclosure Rule in practice. Complete with links to vital DOL documents.

Isn’t it ironic that the very people who 401k plans were created to benefit have decided it’s easier to ignore the maze than to constructively participate. Allowing the 401k to evolve up to today’s technology will solve many problems.

The current economic setting only heightens fiduciary liability. Last year, the DOL logged more than 4.5 corrected violations per business day. With aggressive litigators using technology to sniff out these violators and others, what’s a 401k plan sponsor to do?

Where’s the best place for the 401k plan sponsor to go for free help on their fiduciary duties and responsibilities?

Fiduciary News Trending Topics for ERISA Plan Sponsors: Week Ending 8/26/11

A week with compliance news coming in from all sides. What issue will have the greatest impact?