Regulators (including the DOL) seem intent on splitting the baby in half by allowing two incompatible business models – one fiduciary with no self-dealing fees, the other non-fiduciary with conflict-of-interest fees – to coexist within the same market. Does this mean “fiduciary” has lost its inherent advantage?

Tag "Jairo Gomez"

Here’s quick read with a surprise reveal. Can you find it?

Was “fiduciary” done in by over-saturation? Or was it the victim of a super successful negative campaign? Or is there something missing in our analysis?

The Meat and Potatoes Topics of 401k Plan Sponsor Training: Fiduciary Education Curriculum (Part II)

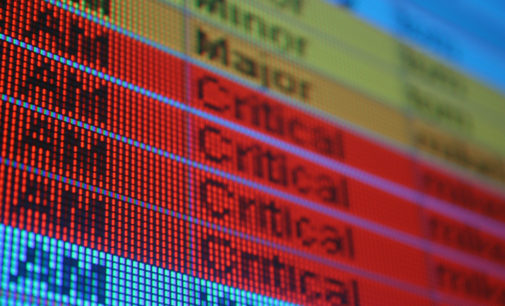

If we liken the “5 Critical Topics” to the skeleton and sinew of a plan sponsor’s fiduciary obligation, the “meat and potatoes” topics can be described as its soft underbelly. It is within the routines of these topics that plan sponsors live most dangerously. What are these next two topics and why is it important plan sponsors to dig deep into them rather than simply “read the headlines”?

These are fundamental in nature. They are necessary prerequisites for 401k plan sponsors to fully inculcate themselves with more complex topics.

There’s a chance for savers to increase the odds they’ll retire in comfort thanks to the 2017 tax law. Here’s how, but the window of opportunity will close fast.

Just because something is measurable doesn’t mean it’s relevant.