“This lack of active involvement could lead to inefficiencies, reduced liquidity, and potential market instability, as prices may not accurately reflect the underlying value of securities.”

Tag "passive"

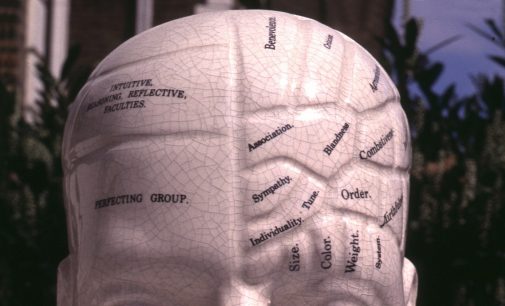

401k plan sponsors can’t afford to fall victim to the lure of heuristics. Index funds can generate just as much fiduciary headaches as actively managed funds.

Compliance mixed bag, SEC BI DOA? and “Investments: The Sequel”

Retirement policy freak out, fiduciary rumbles, and “She Loves Fees” (yeah, yeah, yeah).

A good fiduciary needs to see through the hype and base decisions solely on matters of import. This isn’t as easy as it sounds. For one thing, hype, like humor, works because it’s based on truth. This mantle of credibility is just enough to lead the fiduciary astray.

The controversial and decidedly partisan report not only took aim at the policies of the current administration, it entered into the passive/active debate by solely targeting actively managed funds. Worse, the report reveals a rather naïve understanding of mutual funds and investing.

The wrong way to save retirement, the truth about “clean” shares, and Investing: It’s all your fault!

State pension implosion, a regulation without teeth, and the fee-value correlation.

FiduciaryNews.com Trending Topics for ERISA Plan Sponsors: Week Ending 5/24/19

SECURE Act recap, BI coming, and ESG sizzling.