Today, in reading some of the headlines, you’d think they’re greater than sliced bread. They may be. They may not be. Still, there are differences, and 401k plans sponsors would benefit from practicing the utmost in due diligence when determining if CITs are the right fit for their plan.

Due Diligence

If the numbers don’t add up for annuities (or anything else, for that matter), where is the demand for these products coming from?

There’s not a sin in listening to radio shows sponsored by those selling gold and silver. It’s quite another thing to actually act on their “recommendation.”

Normally, interest rates rise with inflation. In turn, bond rates rise with interest rates. But that hasn’t happened. In fact, short rates remain at historic lows. This means folks sitting in money markets or “safe” government bonds (and bond funds) are seeing their retirement savings eroded away.

The conflicts-of-interest inherent in selecting proprietary funds are apparent. Less so are the criteria used to determine what a suitable process might be.

But that idea contained a flaw. In the early years, limited choices made it easy for employees. The proliferation of the number of options in later years, however, exposed the lack of sophistication within the employee cohort. That can lead to bad decision-making. Alternative solutions were needed.

Depending on what the plan sponsor decides to place on the 401k menu, plan participants might have an easier time dealing with making investment choices to battle the ravages of inflation.

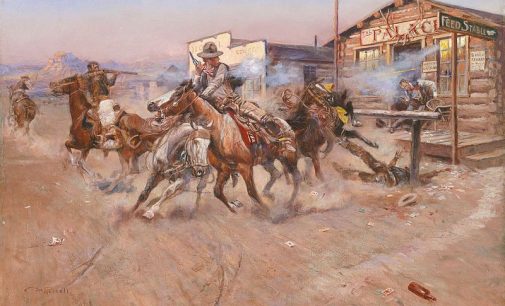

It’s not a simple matter of flipping a switch and allowing cryptocurrencies in plans. Because these are alternative investments, the plan sponsor will need to learn enough about them to make an informed decision.

The problem with Sequence of Return Risk is that there’s no way of knowing if you’ll experience it. It’s a roll of the dice. The best way to avoid this risk is to prepare as if it were going to happen.