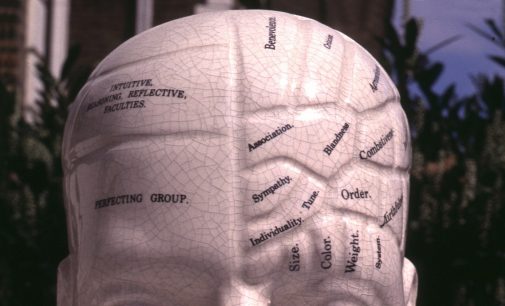

A good fiduciary must keep a level head and know when emotions drive investors. After all, if they’re not careful, emotion will drive investors right off the cliff.

Due Diligence

When retirement industry professionals talk about the impact of the 2006 Pension Protection Act, you might be surprised that this is what they conclude.

A fiduciary who only looks at the most recent reporting period stands to make an unfortunate – and potentially damaging – investment decision… and unnecessarily exposes himself and his company to a liability that can otherwise be easily avoided.

Worse, those held accountable for the potential damage of the flaw are not these detached organizations, but the professionals implicitly promoting the festering error – regular people ranging from bank trustees hired to guard the interests of beneficiaries to retirement plan sponsors and trustees responsible for protecting their employees.

Would you rather have the nuts and bolts practical guide for what to ask or the theoretical questions that tend towards the philosophical? Most 401k plan sponsors are too busy for theory, that’s why they’ll prefer to focus on these questions.

If you’re a fiduciary and you haven’t ask this question, you might want to read this before you make your next decision.

The controversial and decidedly partisan report not only took aim at the policies of the current administration, it entered into the passive/active debate by solely targeting actively managed funds. Worse, the report reveals a rather naïve understanding of mutual funds and investing.