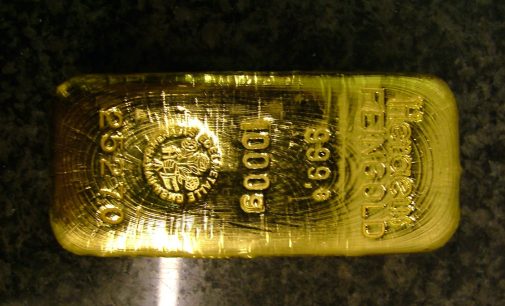

There’s not a sin in listening to radio shows sponsored by those selling gold and silver. It’s quite another thing to actually act on their “recommendation.”

Tag "401k"

If you’re a fiduciary of the acquiring plan, you want to make sure you’re not burdened with any unknown liabilities. If you’re a fiduciary of the acquired plan, you want to make sure the merger process doesn’t introduce new liabilities.

What would it take to realize the fiduciary liability of overtly using “risk tolerance” metrics? And what can 401k plan sponsors do about it?

But that idea contained a flaw. In the early years, limited choices made it easy for employees. The proliferation of the number of options in later years, however, exposed the lack of sophistication within the employee cohort. That can lead to bad decision-making. Alternative solutions were needed.

How do we design and administer retirement plans?

It’s not necessarily something that can be done at the flick of a switch, but it can be baked into the process.

If a company sees a substantial number of employees exit their firm, this can have a detrimental impact on all areas. Even the company’s 401k can be negatively affected in a number of ways.

In theory, 401k plans were always intended to be highly portable, but that’s not what happened. “Portability” only evolved to the extent that the most-attractive balances were picked off and rolled over to IRAs, and everyone else was left holding the bag.

The Biggest 401k Fiduciary Fireworks, Fizzles, And Flops In 2021

Flops may not be forever. They may just be good ideas before their time. If you’re going to belittle them, you best hurry, because, if you wait too long, you may just discover they aren’t flops anymore. As a result, let’s not waste any time before the shelf-life of these flops expire.