With contributions via employer programs not beginning until July 4, 2026 (IRS Notice 2025-68), sponsors who move quickly have a compressed window to design, test, and communicate the benefit. That compression creates both opportunity and risk.

Tag "Child IRA"

Could Employer Matching On Trump Accounts Become The Next Fiduciary Recruiting Perk (And Liability)?

We asked retirement advisors from across the country whether they felt SECURE 2.0 had been over-hyped or represented a game changer. Here’s what they said on a few key issues.

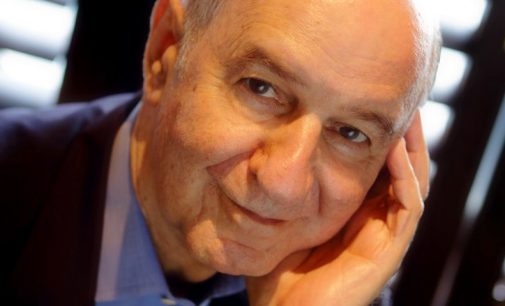

“I was [once] a major skeptic of the use of annuities, I have subsequently changed my mind regarding the efficacy of low-cost fixed and variable annuities in both personal and retirement accounts.”

Long industry veteran tells it like it is. How will his comments change your thoughts on these important subjects?

Today, directly or indirectly (“back door”), every wage earner can contribute to a Roth IRA. So, to benefit your (great)(grand)child through “long term investing”, you might consider funding a Roth IRA and/or Roth 401k.

When it comes to the definitive fiduciary, no one can play that role better than the parent. Parents constantly look out for their children. They want to give their children the best possible advantage to live a better life. Why not give them the ultimate head-start?

Why are financial professionals more likely to embrace behavioral finance and how can this help the average investor?

“…anytime we are talking about disclosures, don’t make them like the lovely 404a notices. Make them simple and easy to understand. Otherwise you lose the whole point of the disclosure.”

FiduciaryNews.com Trending Topics for ERISA Plan Sponsors: Week Ending 4/5/19

New regulatory guidelines, Will fee “clarity” lead confusion? and What’s on your menu?