The secret to successfully using behavior finance is to understand it, like the typical 401k participant, has nothing to do with investment theory.

Posts From Christopher Carosa, CTFA

Post IRS, can DC be trusted with Fiduciary? Meanwhile, pop culture tries to define Fiduciary as there appears to be something strange brewing in the markets.

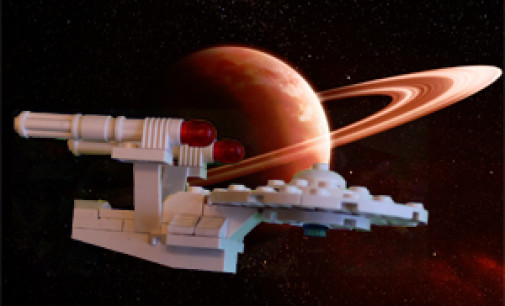

Star Trek’s Fiduciary Rule: The needs of the many (or the client) outweigh the needs of the one (or the fiduciary).

Will small businesses punt 401k plans? How Fiduciary Advocates can fight back. Coming Soon: The Revenge of the Market.

Let’s recognize the researchers, scholars, policymakers, regulators and tireless advocates who work to advance fiduciary principles.

FiduciaryNews Trending Topics for ERISA Plan Sponsors: Week Ending 5/31/13

The week reveals the sometimes uncomfortable truth about fees, fiduciary and fixed income.